Demand Surge for Hafnium Pushes Price to All-Time High

The raw materials market for hafnium is undergoing considerable movement. Demand for the technology metal is increasing as a result of the booming aerospace and nuclear industries. Additional demand for semiconductors has led to further supply shortages and a price increase of almost 200% within twelve months.

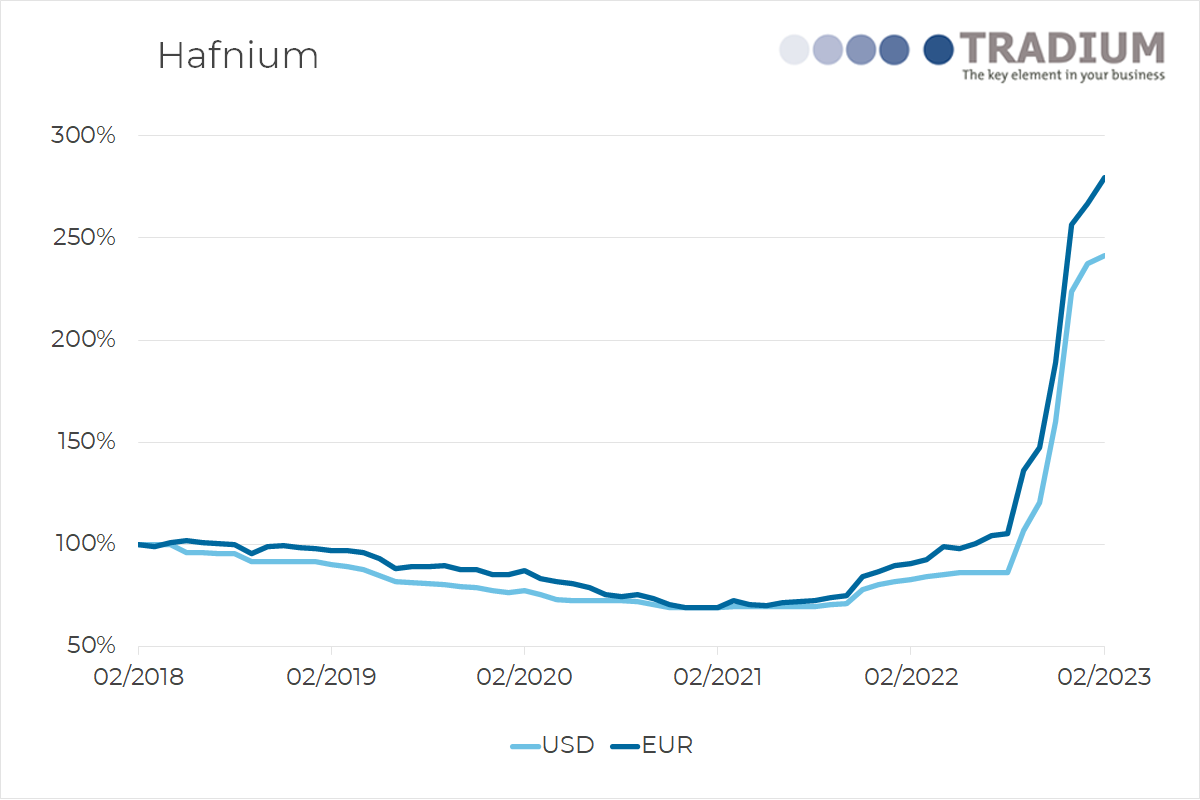

Frankfurt, March 27, 2023 – TRADIUM GmbH, one of the most renowned suppliers of strategic metals in Europe, is currently observing strong movement in the raw materials market for hafnium. In recent months, a boom in orders from various economic sectors has led to a significant increase in demand for the metal. In particular, the aerospace, nuclear, gas turbine, and semiconductor industries continue to report rising demand that is depleting inventories and limiting the availability of the raw material. As a result, the price of hafnium has soared to record levels. In the past twelve months, it has risen by 190%.

The price development of hafnium in the last five years.

Important raw material for industry

According to TRADIUM raw materials expert Jan Giese, the two most important applications of hafnium are in the aircraft industry and for control rods in the nuclear industry. As an alloying addition combined with niobium, tantalum, and molybdenum, hafnium provides aircraft turbines with high strength, temperature stability, and corrosion resistance. These material properties also make hafnium alloys essential for the production of gas turbines. The semiconductor industry also relies on the metal to produce ever-faster and smaller computer chips.

Rising demand in the post-Covid 19 economic boom

Global production of hafnium in various grades is currently estimated to be 70-80 tons. “This is a small number compared to other technology metals such as gallium or indium, of which 700 and 1,000 tons respectively are available per year,” explains Giese. The comparison with gold, whose annual production is 3,500 tons, is even starker. Nevertheless, the annual production of hafnium has so far met industry needs, meaning that the market has been well balanced. During the economic crisis in the Covid-19 years – for example, in aircraft construction – there was even a brief oversupply. But Giese says the market has now turned around. “Air traffic is picking up significantly and aircraft manufacturers are reporting full order books. In addition, new nuclear reactors are being planned worldwide. Demand in both industries is significantly higher than before Covid-19, and raw material stocks are correspondingly empty.” In the semiconductor industry, which according to a McKinsey market report is growing at an annual rate of up to 8%, increasing purchase volumes are also expected.

Hafnium: Raw material shortage looming

In its raw form, hafnium is a byproduct of zircon production and is very costly to extract. Frank Meier, Senior Manager of Minor Metals & REE at TRADIUM, explains: “The metal is extracted at a ratio of about 1:50. So for every ton of hafnium, 50 tons of zirconium are needed.” “Despite high prices, producers have little interest in increasing hafnium production because they would also have to extract and stockpile a large amount of zirconium at the same time,” adds Meier. This is why production volumes of hafnium cannot be scaled up at will. Given the increasing demand, he said, supply shortages cannot be ruled out.

Well-stocked warehouse with hafnium and other strategic metals

TRADIUM has high stocks of hafnium thanks to its broad partner network and forward-looking raw material procurement. The metal is available in standard grades and with special product specifications. Meier says: “Our supply chains are widely diversified to prevent outages and shortages.” TRADIUM also keeps large quantities of other metals in its high-security warehouse. They include numerous rare earths and other technology metals. More than 20 business-critical raw materials are available for prompt delivery from Frankfurt am Main in various purities and forms.

Besides strategic metals, TRADIUM also provides up-to-date news on the raw materials markets. The company blog for the private customer sector issues regular updates on new applications of strategic metals and the development of demand. The company posts monthly price charts on strategic metals TRADIUM also supports the news portal rawmaterials.net, which provides daily updates on rare earths, technology metals, and precious metals.

Photo credits for the preview image: TRADIUM GmbH